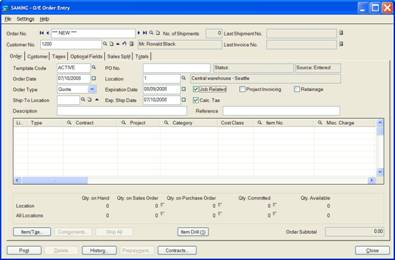

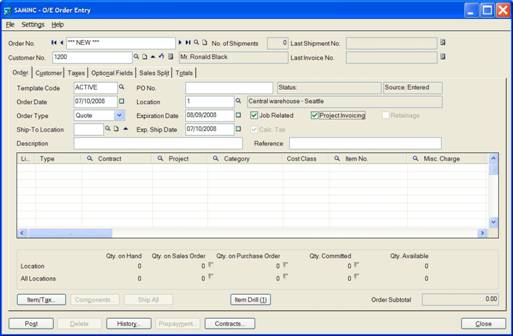

With the Order Entry and Project and Job Cost modules, you can now enter job-related orders in the Order Entry module and track project costs in Project and Job Cost (PJC).

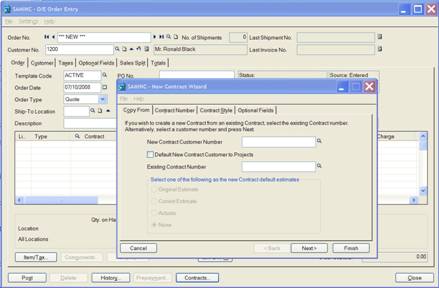

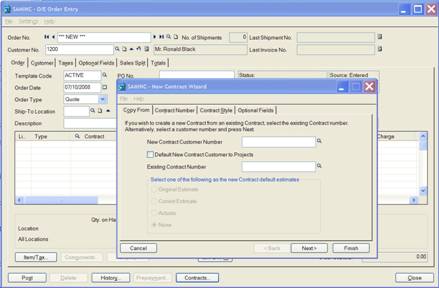

You can enter a quote in Order Entry and create the contract in PJC on the fly using the New Contract Wizard. The New Contract Wizard lets you copy an existing contract to make the new one. This means that you can create one or more contracts in Project and Job Cost that act as templates for all the new contracts created in Order Entry.

When you post the quote, Order Entry sends estimates of the quantity, total cost, and total revenue to Project and Job Cost.

When you change the quote to Active and post it in Order Entry, Project and Job Cost changes the project status to Open.

Orders can list material details items from inventory used on the job and they can list miscellaneous charges, which can be PJC categories like labor, equipment, subcontractor, or overhead charges, or miscellaneous charges such as shipping and handling.

If an order is designated as job-related, all detail lines on the order must be job-related.

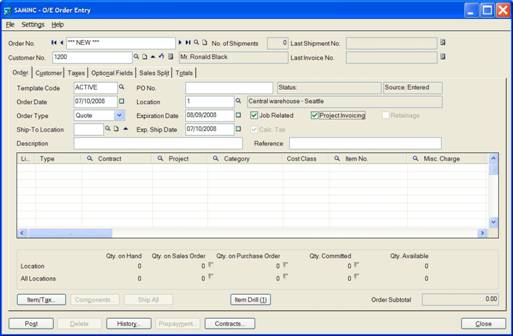

Order Entry lets you handle the complete order processing cycle in Order Entry, or create the order and shipment in Order Entry and manage the billing and invoicing in the Project and Job Cost module (called Project Invoicing).

You can choose to post job-related invoices in Order Entry for projects that use item invoicing (except for projects that use the completed project accounting method). When you post the invoices in Accounts Receivable, Accounts Receivable updates Project and Job Cost with the cost and billing information.

Setting Up Contracts in PJC from Order Entry

You can set up template jobs that you can copy for each new order using the New Order Wizard in Order Entry or you can set up jobs that are used by groups of orders.

The wizard copies the settings, projects, categories, and resources from the existing contract to the new contract. The wizard also lets you choose to use original or current estimates, actual revenues and costs, or no amounts from the existing contract as the default estimate for the new contract. You can also choose whether to use the same Optional Fields as the existing contract or the program default Optional Fields.

If you are entering a job-related quote, the quote details must be applied to projects that have an Estimate project status in Project and Job Cost. (The contract can have an Open status, but the project status must be Estimate.)

When you change the order type of a job-related order from Quote to Active, the program will change the project status of all projects listed in the order details from Estimate to Open.

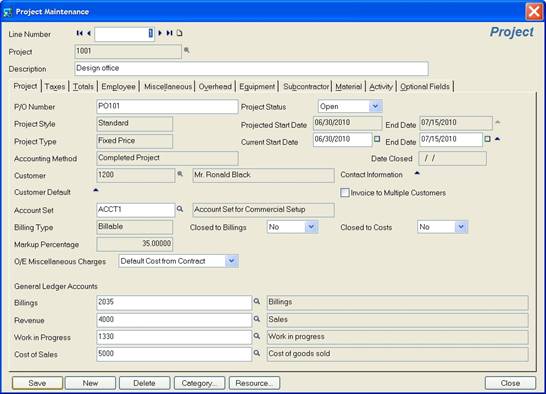

On the Project tab in PJC Contract Maintenance, you can also choose for projects:

- Whether the default cost for miscellaneous charges comes from the miscellaneous charge record or from the contract.

- Whether the billing rate comes from the contract billing rate, from the customer price list, or from a price list specified for the project. (Accrual-basis or billings and costs projects only.)

Setting up the Integration between Order Entry and PJC

Setting up the Project and Job Cost integration with Order Entry includes:

- Deciding how you are going to invoice customers in Order Entry or in Job Cost.

- Deciding the default method for calculating costs on job-related documents you process in Order Entry.

- Deciding the default method for billing amounts on job-related documents you process in Order Entry

Deciding How to Invoice Job-Related Orders

One of the most important processing decisions is how you are going to invoice orders/jobs.

Order Entry lets you handle the complete order processing cycle in Order Entry, or create the order in Order Entry and manage the billing and invoicing in the Project and Job Cost module.

- Service providers normally invoice directly from Order Entry.

A series of service calls can apply to a single project, or you can create new projects for each call. Order Entry lets you create new contracts on-the-fly when you create new quotes. The details for each new contract can be copied from an existing contract—which you can use as a template.

- Companies with more lengthy or complex projects, such as construction companies, normally use project invoicing, and will likely process addition costs through the Accounts Payable module.

Posting the shipment in Order Entry completes the transactions for the Order Entry module. The transaction is sent to Project and Job Cost, where it calculates the extended billing amount and the cost portion of the order.

You can then process the billings for the transaction by using Project and Job Cost’s Create Billing Worksheet when the project status is set to Completed or by manually entering an invoice in Accounts Receivable. (The Accounts Receivable lets you bill customers for completed projects when the projects status is set to open.)

The following chart shows which types of projects can be invoiced in Order Entry and which have to be processed in Project and Job Cost.

Decide Whether to Record Costs and Charges in Order Entry

You can now record job-related non-material costs in Order Entry as miscellaneous charges. Order Entry sends both cost and revenue amounts to Project and Job Cost. Miscellaneous charges can have two different functions on job-related orders:

- Allows you to add additional charges to customer orders for invoicing external charges such as freight (UPS or FedEx).

- Allows you to record internal non-material transactions such as equipment, subcontractors, labor, etc.

You can also process job-related item costs on sales orders in Order Entry, as well as on receipts in Purchase Orders.

Specify a Default Cost for Miscellaneous Charges

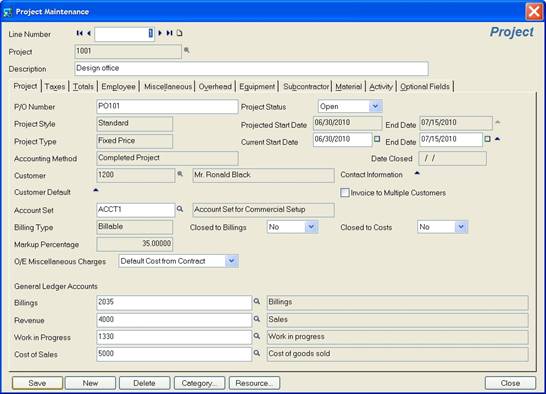

You use the option O/E Miscellaneous Charges on the Project tab of the Project Maintenance form to specify whether to use this cost by default for the miscellaneous charge or use the PJC contract cost.

- Default Cost From Misc. Charges – If you select this option, the extended cost and extended amount specified in the miscellaneous charge setup record in Order Entry are used as defaults.

- Default Cost From Contract – If you select this option, the cost specified for the miscellaneous charge for the project category (on a basic project) or the resource category (on a standard project) is used as the default.

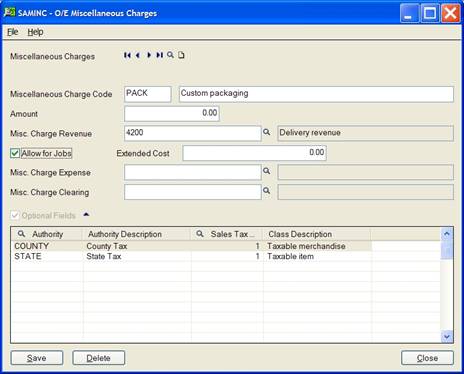

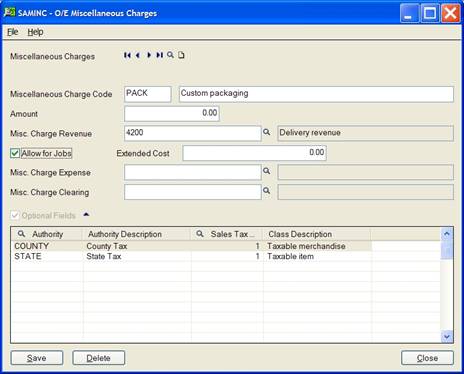

Setting up Miscellaneous Charges for job-related orders

To create miscellaneous charges for job-related orders, you must select the Allow For Jobs option on the Miscellaneous Charges form in Order Entry, and then specify:

- An extended cost – For each project in PJC, you can choose to use this cost by default or use the contract cost.

- A miscellaneous charge expense account

Order Entry credits the expense account and debits the miscellaneous charge clearing account when you ship goods and run Day End Processing. (When you post the invoice, it credits the clearing account and debits cost of goods sold.)

- A miscellaneous charge clearing account.

The miscellaneous charge clearing account is similar to the shipment clearing account. Order Entry debits the clearing account and credits the miscellaneous charge expense account when you ship goods (and run Day End Processing). It then credits the clearing account and debits cost of goods sold when you post the invoice.

Miscellaneous charges can be assigned to categories with any cost type except material. You must use item detail lines on orders for material cost types.

Note that you can choose by project in Project and Job Cost whether to use the amount specified in Order Entry for the miscellaneous charge or use a default billing rate specified for the contract in PJC.

Before processing miscellaneous charges in Order Entry, you should be aware that:

- There is a risk that you can record the same costs twice.

- There are some differences in the calculation of overhead for job-related material costs you process in Order Entry and those you process in Purchase Orders.

Double-Recording Item Costs or Miscellaneous Charges

Processing errors can arise when you bill customers for external charges services or goods that are actually provided by a third party and that you receive in Purchase Orders or record in Accounts Payable.

If you are processing goods or services for a job through several accounting modules, you must decide which modules are going to record the costs and assign them to jobs.

For example, if you enter a job-related PO in the Purchase Orders module, and assign items to a specific contract, project, category, and resource (if applicable), and then create a customer order in Order Entry and assign the same items to the same contract, project, category, and resource, the work in progress account will be overstated, (costs recorded twice) and so will Contract Maintenance.

Similarly, if you enter a job-related order in Order Entry that includes a shipping miscellaneous charge, and then process an A/P invoice for the same charge and treat it as a job-related invoice, you will double-record charges for the job.

If you are invoicing in Project and Job Cost, it might make more sense to omit the miscellaneous charge on the order in Order Entry and record the transaction in Accounts Payable. The shipping charge for the job will then be picked up on the billing worksheet and included on the invoice created in Accounts Receivable.

In any case, you have to decide when and how you want to transfer costs to jobs, and then set up the procedures for processing those costs.

Updating overhead and labor costs in Project and Job Cost

You should also note that Project and Job Cost calculates overhead based on actual quantities for purchase receipts and sales orders for project categories that use the Flat Rate Per Unit overhead calculation. However, the calculations vary, depending on which program you use to process the costs:

- For job-related costs you process in Purchase Orders, Project and Job Cost calculates overhead and labor for amounts that exclude taxes.

- For job-related costs you process in Order Entry, Project and Job Cost calculates overhead and labor for amounts that include allocated and expensed taxes.

Specify a Default Billing Rate for a Project

The Project tab on the Project Maintenance form lets you specify a default billing rate for documents you process in Order Entry and for material usage and material returns transactions you process in Project and Job Cost.

For projects that use a billing rate (such as time and materials projects), you use the new Default Billing Rate option to select one of the following sources:

- Billing Rate – Select this option to use the billing rate specified for the project. (On a standard project, the billing rate is assigned to each material resource; on a basic project, the billing rate is assigned to the category.)

- Use Customer Price List. Select this option to use the price list for the specified customer to determine the billing rate.

- Use Specified Price List. Select this option to use a price list defined in Inventory Control. If you select this option, an additional new field appears that lets you enter the specific price list.

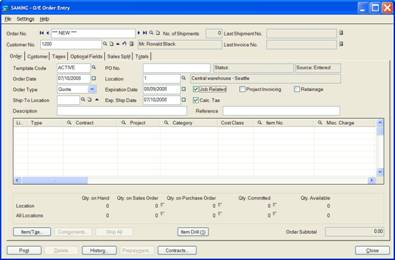

Understanding Detail Lines in Job-Related Orders

Each detail line on a job-related order must be applied to an existing cost category in an open contract and project. Item details assign inventory items to jobs, so the category cost type to which they apply must have a material cost class. Miscellaneous charge detail lines let you assign costs for all other cost classes labor, equipment, subcontractor, overhead, and miscellaneous cost.

When you select the Job Related option, additional fields appear in the detail-entry grid to let you enter job-related information for each item or miscellaneous charge on the order or quote. You can also choose the following options:

- Retainage accounting (Note that the Retainage option will not be available if you choose all invoicing to be handled by PJC.

Retainage is where a percentage of the payment is held back for a fixed period of time, when it is separately invoiced. You select the Retainage option to indicate that retainage applies to the document you are entering.

When you select the Retainage option, a Retainage tab appears on the Order Entry form where you specify how to process the retainage invoice for this order.

- Project invoicing – If you select this option, all of the billing for this order will be handled by the Project and Job Cost module. Order Entry will not create an invoice for this order, but will pass all information to Project and Job Cost for it to process billings using the Create Billing Worksheet.

If you use Project and Job Cost and expect to create orders or shipments for non-existing customers, you should choose a default template that includes a tax group. (If you choose project invoicing with a non-existing customer, you cannot edit the tax group. If it is blank, you will not be able to add order details.)

When you post the document, Order Entry will update the contracts, projects, categories, and (if required) resources in Project and Job Cost to which the items in this order apply.

Using I/C Unit of Measure Conversion Factors

If you are entering job-related orders or shipments where the Default Order UOM = Pricing Unit (set in the O/E Options form) and the Default Billing Rate = Billing Rate (set for the project in the Project and Job Cost module), Order Entry will default the unit of measure from the current price list, and then re-calculate the unit price based on the billing rate specified in PJC Contract Maintenance.

When you post job-related material transactions in Order Entry, Project and Job Cost converts the quantity used in the transaction to the unit of measure used for the specified project resource category. To make the conversion, the program uses the conversion factor specified for the unit of measure in the item record in Inventory Control.

Using Fractional Quantities

If you do not use fractional quantities in Inventory Control, you use the stocking unit of measure when you set up resource categories for your projects. Otherwise, if you post units of measure that are less than the I/C unit of measure used for a resource category, the quantities shown for the resource category in Contract Maintenance are rounded to a whole number and may be misleading.

For example, if you post 5 “each” in Order Entry, but Project and Job Cost uses “dozen,” the quantity that appears for the resource category is 0.

Taxes

Although Project and Job Cost allows tax groups to be specified by project, if you are producing the invoice in Order Entry, the tax group specified for the order applies to all contracts and projects listed in the O/E document details.

If you require different tax groups for different contracts and projects, they will have to be entered on separate orders.

Note: If the document is set for Project Invoicing, the tax group of the project will be used to calculate the tax because the invoice will be generated in Project and Job Cost.

Prepayments

When you record job-related prepayments, you also distribute the payment amount to the details on the order. Order Entry lets you automatically prorate payment amounts to individual details or do a “top-down” distribution, starting at the category, and resource, the work in progress account will be overstated, (costs recorded twice) and so will Contract Maintenance.

Similarly, if you enter a job-related order in Order Entry that includes a shipping miscellaneous charge, and then process an A/P invoice for the same charge and treat it as a job-related invoice, you will double-record charges for the job.

If you are invoicing in Project and Job Cost, it might make more sense to omit the miscellaneous charge on the order in Order Entry and record the transaction in Accounts Payable. The shipping charge for the job will then be picked up on the billing worksheet and included on the invoice created in Accounts Receivable.

In any case, you have to decide when and how you want to transfer costs to jobs, and then set up the procedures for processing those costs.

Cost of Kitting Items in Job-Related Orders

Kitting items are treated differently in Project and Job Cost than they are in Order Entry.

In Order Entry, a kitting item is a collection of separate items, where revenue is recognized at the master level, but costs are recognized for each item in the kit.

In Project and Job Cost, however, a kitting item is treated as a single item for both revenues and costs.

This means that for job-related orders:

- Order entry adds the cost of all kit components to create a single cost for Project and Job Cost, so PJC can recognize one revenue amount and one cost amount.

- If you match transactions from Inventory Control with those from Project and Job Cost, I/C will provide G/L with a string of component cost entries, whereas PJC will provide G/L with a single master cost.

Posting Job-Related Shipments and Invoices

Job-related transactions can take two separate paths. You can invoice orders through Project and Job Cost (by choosing the Project Invoicing option) or you can create invoices in Order Entry.

Order Entry lets you create job-related orders in Order Entry and manage the billing and invoicing in the Project and Job Cost module by using the Project Invoicing option.

If you are using project invoicing, posting the shipment in Order Entry completes the transactions for O/E. The transaction is sent to Project and Job Cost, for it to calculate the extended billing amount and the cost portion of the order.

You can then process the billings for the transaction:

- By using Project and Job Cost’s Create Billing Worksheet when the project status is set to Completed.

- By manually entering an invoice in Accounts Receivable. (Accounts Receivable lets you bill customers for completed projects when the projects status is set to open.)

If you choose project invoicing, you cannot invoice an order or shipment in the Order Entry module.

Note: You cannot post credit notes for job-related project invoicing documents. Because of this, Order Entry lets you enter negative shipments for these job-related orders.

Download our corporate brochure for more facts about us, our

clients and our solutions.

Download our corporate brochure for more facts about us, our

clients and our solutions.

Driving Revenue Growth 1

Driving Revenue Growth 1 Satisfying Customers 1

Satisfying Customers 1